Have you heard about first-time buyers buying a house without a mortgage?

Possibly children of the super-rich can have their first house as a gift from their parents, but the rest of us can’t buy a property just from our savings, we need to borrow money from a bank.

A mortgage is a loan that is secured against a property, and the difference from a typical unsecured loan is that they are usually cheaper, as the banks have a lower risk of losing their money. If something goes wrong, and the customer can’t pay the monthly payments, the bank can take the house instead to recoup their money. If that happens, houses are often sold at a low price so there is little or nothing left for you.

Getting the first mortgage is more difficult because when you do something for the first time, it’s easy to make a mistake. Also, since banks consider first-time buyers as more risky customers, don’t be surprised when they offer you higher mortgage rates than you expect.

It is worth using professional help from a mortgage adviser but you will be better prepared to talk to them if you already know what you need by that point, and you will understand better if what you are offered is good for you.

What mortgage to choose?

A good mortgage broker will save you a lot of time and help you to avoid mistakes. They know lenders’ requirements and to protect your credit history they will not recommend a lender if there is a high chance of rejection.

But to have a meaningful conversation and take full advantage of their advice you better learn more about mortgages.

Mortgage interest rates

This is the cost of borrowing the money. In a simple loan, if you borrow £100 for a month at 5%, you must return £105 at the end of this month. The maths is getting a bit more complicated with mortgages as usually they are quite long, 25 or more years, and you pay your payments to the bank monthly. If you also repay the capital, maths is getting even more complicated, but you can use a mortgage calculator, there are many of them, just google.

When you look at mortgage tables, they often show LTV (Loan-To-Value ratio, which shows the percentage of the property price given by the bank as a loan).

Your deposit + Loan (mortgage from the bank) = House price (received by the seller)

5% + 95% LTV = 100%

10% + 90% LTV = 100%

Table 1. Property value £200,000, mortgage term 30 years, 2-year fix-rate mortgage, repayment

| Deposit | LTV | Mortgage amount | Lender | Initial rate | Monthly payment | Product fees | Initial term cost over 2 years | APRC |

| 40% | 60% | £120,000 | Co-operative bank | 5.04% | £647 | £1,999 | £17,527 | 8.12% |

| 40% | 60% | £120,000 | Co-operative bank | 5.39% | £673 | £16,152 | 8.12% | |

| 25% | 75% | £150,000 | Co-operative bank | 5.18% | £821 | £999 | £20,703 | 8.12% |

| 25% | 75% | £150,000 | Halifax | 5.55% | £856 | £20,544 | 8.74% | |

| 15% | 85% | £170,000 | Co-operative bank | 5.57% | £972 | £1,999 | £25,327 | 8.12% |

| 15% | 85% | £170,000 | Virgin Money | 5.90% | £1,008 | £24,192 | 9.49% | |

| 10% | 90% | £180,000 | Virgin Money | 5.70% | £1,045 | £1,295 | £26,375 | 9.49% |

| 10% | 90% | £180,000 | Virgin Money | 5.90% | £1,067 | £25,608 | 9.49% | |

| 5% | 95% | £190,000 | Newcastle Building Society | 5.99% | £1,138 | £999 | £28,311 | 6.94% |

| 5% | 95% | £190,000 | Hantley Economic Building Society | 6.39% | £1,187 | £28,488 | 7.99% |

With only a 5% deposit you will pay almost £11K more than with a 40% deposit during only two initial years, over the term of the mortgage the difference will be even bigger, so it makes sense to save as much as you can for the deposit.

Repayment or interest only?

Interest-only mortgage

A mortgage where only interest is paid monthly and there is no capital payment part. The mortgage amount remains the same, and you still need to repay it in full when you remortgage or sell the house. There are no longer many such products for residential houses, although the majority of BTL (Buy-to-let) mortgages are interest-only.

Repayment mortgage

A mortgage in which a share of borrowed capital is repaid every month together with the interest.

Mortgage interest of 6% means that 6% is charged per year on the amount you borrow. For example, if you borrowed £150,000, 6% interest of £150,000 will be £150,000 x 0.06 = £9,000.

If it’s an interest-only mortgage, it is easier, monthly payments are just 1/12 of the total yearly interest. In our example: £9,000/12 = £750 per month.

It’s getting more complicated if it’s a repayment mortgage.

If you repay part of your capital regularly, it means the amount that you owe to the bank is getting smaller. So, the interest charge should be getting smaller too.

Banks usually calculate the monthly payments in such a way that the monthly payments stay the same during the initial fixed period. Initially, almost all of your monthly payments will be interest, just a small amount is capital repayment, but at the end of the mortgage term, when the remaining loan is getting smaller, the biggest part of the monthly payment is capital.

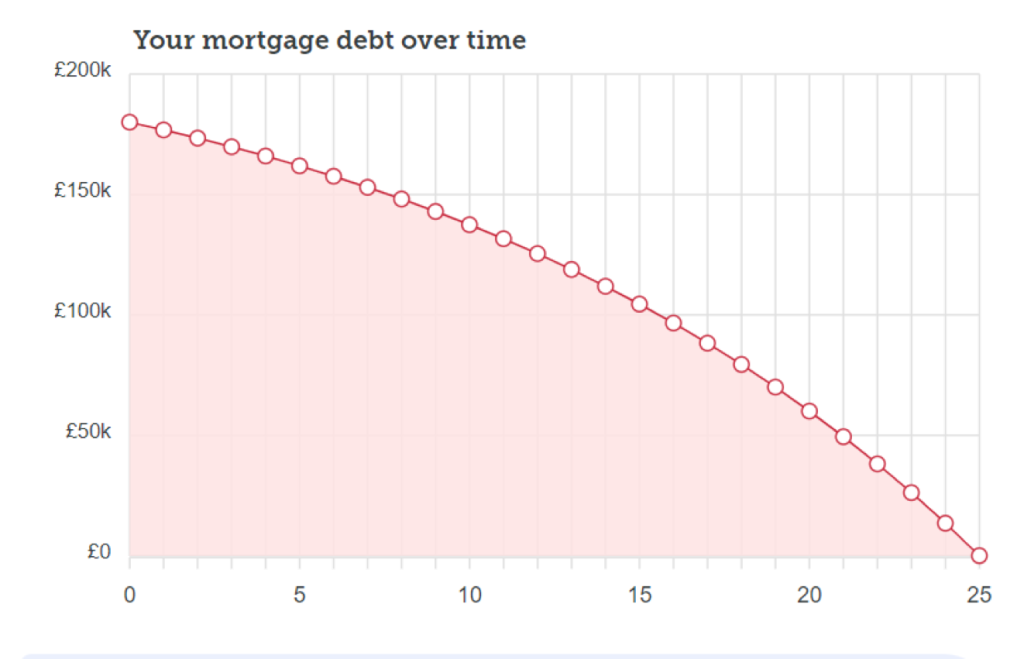

Example £180.000, 25 years, 6% Monthly payments £1,160

| Table 2 Capital left over the life of the mortgage | |

| Year | Remaining Debt |

| 0 | £180,000 |

| 1 | £176,797 |

| 2 | £173,396 |

| 3 | £169,786 |

| 4 | £165,953 |

| 5 | £161,883 |

| 6 | £157,562 |

| 7 | £152,975 |

| 8 | £148,104 |

| 9 | £142,933 |

| 10 | £137,443 |

| 11 | £131,614 |

| 12 | £125,426 |

| 13 | £118,856 |

| 14 | £111,880 |

| 15 | £104,474 |

| 16 | £96,611 |

| 17 | £88,263 |

| 18 | £79,400 |

| 19 | £69,990 |

| 20 | £59,999 |

| 21 | £49,392 |

| 22 | £38,130 |

| 23 | £26,174 |

| 24 | £13,480 |

| 25 | £0 |

For interest-only mortgages, the monthly payments are much lower as you don’t need to repay the capital, but it’s almost impossible to find such products, especially for first-time buyers, and I would expect that the interest rate will be much higher. For interest-only products, the lender will require that you have a scheme in place to save the money for repaying the loan in full when terms of the mortgage finish, for example, regular investments. Theoretically, if your mortgage rate is 6% and you can invest somewhere at 8%, this could be profitable for you in the long run, but more risky, and it would require much more time and skills.

Type of mortgages

What is better: fixed-rate or variable?

There is no simple answer. It depends on the market condition, your personal financial situation and your preferences regarding stability.

Fixed-rate mortgage

A mortgage with the interest fixed for a certain period of time, typically 2-3-5 years, but there could be 10-year fixed-rate mortgages or even more. The monthly payments stay the same during this period, providing stability, but usually, there is a considerable repayment charge if the borrower wants to get out of it earlier than when the fixed-rate period finishes, so it needs careful planning.

Variable rate mortgages

A mortgage in which the interest rate can go up and down, and as a result, the monthly payments will vary. There are three types: standard variable rates (SVRs), tracker rates and discounted rates.

Base rate The interest rate is set by the Bank of England (BOE), and this is the rate commercial banks are charged for loans by the central bank (Bank of England). It usually affects all other rates: mortgage, saving accounts, deposits, other loans, and the rate at which penalties are calculated. When the base rate goes up, banks also increase their rates for loans, although when the interest rate goes down, they are much slower to decrease their interest rates, and they don’t often drop to the same extent.

Tracker mortgage A type of variable rate mortgage that ‘tracks’ a base rate by adding a fixed amount, for example, 0.5% or 1%, or more. If the base rate changes, the monthly mortgage payments will change as well.

Discounted rate mortgage

The lender offers a discount for a certain period, like fixed-rate mortgages, but the rate is still tied to the base rate and can vary over time if the base rate changes.

Standard Variable Rate (SVR)

It is the mortgage rate set by the lender and applied when the fixed-rate or discounted-rate period is finished. The SVR will be stated in your mortgage offer documents, for example: after the initial fixed-rate period the bank will charge you BOE (Bank of England) base rate plus 2.5%. Unfortunately, lenders can change it if the market conditions change, and it can be higher than it was initially planned.

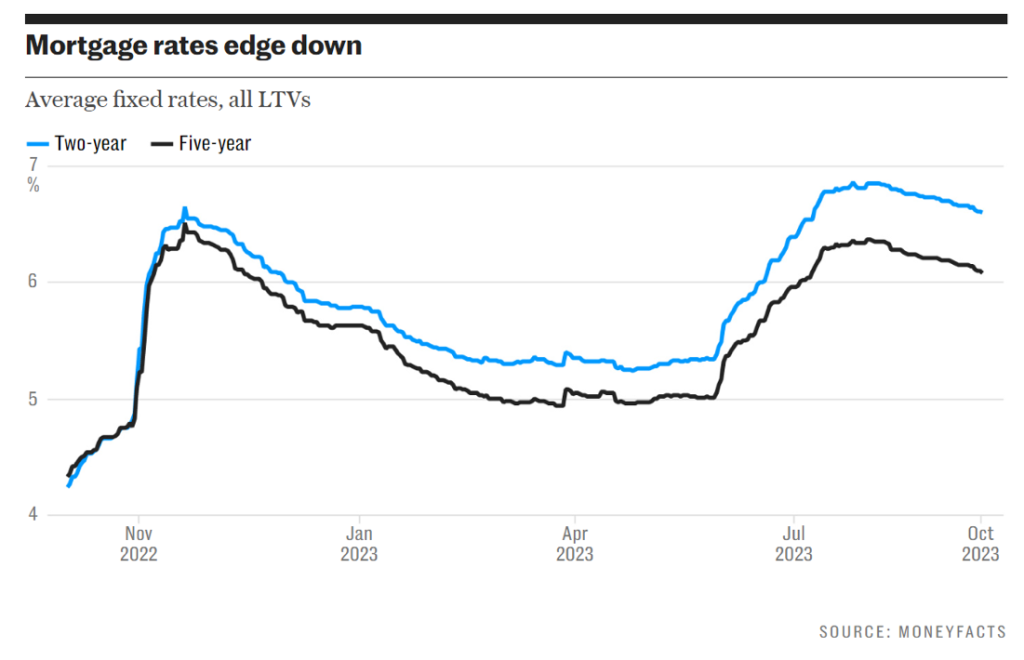

After the mini-budget a year ago, due to financial fallout, tracker mortgages were considerably cheaper than typical 2-year fixed-rate mortgages: 6.65% average 2-year fixed-rate mortgage against 3.77% tracker. For a £150,000 loan it means that tracker monthly mortgage payments were £360 cheaper.

Tracker products offer better flexibility as many of them don’t have exit fees (see more about it later), so many people opted for tracker mortgages with the hope that interests would go down and they could find a cheaper fixed-rate mortgage later.

After ONS (Office for National Statistics) revealed that inflation was lower than expected in August (6.7% against 6.8% in July), BOE decided to keep the base rate at 5.25%. Mortgage got some breath after previous turbulent months, and mortgage rates started to go down, although not especially much.

| Table 3. Property value £200,000, 2-year tracker mortgage, mortgage term 30 years, repayment | |||||||

| Deposit | LTV | Mortgage amount | Lender | Initial rate | Monthly payment | Product fees | APRC |

| 40% | 60% | £120,000 | Natwest | 5.39% | £673 | £995 | 8.24% |

| 40% | 60% | £120,000 | Natwest | 6.19% | £734 | 8.24% | |

| 25% | 75% | £150,000 | Yorkshire Building Society | 5.54% | £855 | £995 | 6.05% |

| 25% | 75% | £150,000 | Yourkshire Building Society | 5.79% | £880 | 6.05% | |

| 10% | 90% | £180,000 | Yorkshire Building Society | 6.04% | £1,084 | £995 | 6.05% |

| 10% | 90% | £180,000 | Natwest | 6.33% | £1,118 | 8.24% | |

Taking into account that the current inflation is still considerably higher than BOE’s target of 2%, the market expects that the base rate can be increased further. Although many analysts agree that we are close to the peak, interest rates are not expected to go down considerably at least for another year.

See the tables for the current mortgage rates. Now, tracker rates are close or even slightly higher than fixed rates, but when the economic situation indicates that we reached the top and when the market starts expecting interest rates to go down, tracker mortgages will become a more attractive option, especially taking into account better flexibility.

Fixed-rate mortgages offer more stability. This is especially important when your budget is tight, and you don’t have much room to cope with possible interest rate fluctuations.

People who have a more comfortable financial position tend to be more likely to choose tracker rates, for example, when they want to overpay more every month, while others who are worried about how they would cope with a potential increase in their mortgage costs, prefer five-year fixes.

2 years or 5 years to fix? Two questions to ask

How long do you plan to stay in this property?

Fixed-rate mortgages come with ERC (Early Repayment Charges), so if you plan to move to another area, or buy a bigger property, you need to take this into account.

Some mortgages are portable, meaning that you can transfer it to another property, but there is no guarantee that the lender agrees that another property will provide the same security for them. At least, check with your lender in advance if you have this option in your mind.

How concerned are you about the economy and your future financial position?

If you want more stability during a longer period, 5-year fix could be a better option for you.

I know that when people planned to change their jobs and were thinking that they might be in between jobs at the time when it comes to re-mortgaging, they opted for 5 years so they have time to settle before their fixed time period came to an end.

According to many mortgage brokers, 2-year fixed-rate mortgages are more popular. 5-year fixed-rate mortgages are cheaper. Some people opt for a shorter period with the hope that by the next time when they need to re-mortgage, rates go down and they can find better rates.

| Table 4. Property value £200,000, 5 year fixed-rate mortgage, mortgage term 30 years, repayment | ||||||||

| Deposit | LTV | Mortgage amount | Lender | Initial rate | Monthly payment | Product fees | Initial term cost over 5 years | APRC |

| 40% | 60% | £120,000 | Santander | 4.64% | £618 | £999 | £38,079 | 8.50% |

| 40% | 60% | £120,000 | Halifax | 4.84% | £633 | £37,980 | 8.74% | |

| 25% | 75% | £150,000 | Santander | 4.74% | £781 | £999 | £47,859 | 8.50% |

| 25% | 75% | £150,000 | Santander | 4.90% | £796 | £47,760 | 8.50% | |

| 15% | 85% | £170,000 | Santander | 5.00% | £913 | £999 | £55,779 | 8.50% |

| 15% | 85% | £170,000 | Santander | 5.13% | £926 | £55,560 | 8.50% | |

| 10% | 90% | £180,000 | Santander | 5.15% | £983 | £999 | £59,979 | 8.50% |

| 10% | 90% | £180,000 | Santander | 5.30% | £999 | £59,940 | 8.50% | |

| 5% | 95% | £190,000 | Scipton Building Society | 5.59% | £1,090 | £1,295 | £66,695 | 6.79% |

| 5% | 95% | £190,000 | Scipton Building Society | 5.69% | £1,101 | £66,060 | 6.79% | |

Generally, when you compare mortgages, you need to consider the mortgage arrangement fees and other associated payments, like the house valuation and lender’s legal fees, and compare all the money you pay during the mortgage term. There are products with zero fees, but they tend to have higher interest, the cheapest rates could have high fees. Depending on the house price and the amount you need to borrow, it’s not always obvious which product is cheaper for you.

To pay the mortgage arrangement fee in addition to the deposit could be a problem for many people, but usually, the fee can be added to the loan, although you will need to pay more interest because of that.

If you need to take other costs into account, checking and comparing mortgages could be a very time-consuming task. Mortgage brokers have access to special software, and they can compare a lot of mortgage products in seconds.

What is ERC?

Fixed-rate mortgages come with a penalty, called ERC (Early Repayment Charges), if you choose to repay the mortgage earlier than the fixed period is ended. The penalty is usually paid on the outstanding mortgage balance, and it can vary, although most lenders allow a 10% overpayment

| Table 5. Early Repayment Charges for fixed-rate periods | ||||

| Year | 2-year period | 3-year period | 5-year period | 10-year period |

| 1 | 3% | 3% | 6% | 6% |

| 2 | 1% | 2% | 5% | 6% |

| 3 | 1% | 4% | 6% | |

| 4 | 3% | 6% | ||

| 5 | 2% | 6% | ||

| 6 | 5% | |||

| 7 | 4% | |||

| 8 | 3% | |||

| 9 | 2% | |||

| 10 | 1% | |||

The longer the fixed period you get, the higher the penalty; see typical penalties in Table 5. If you plan to stay in the same house for 10 years, you can fix the mortgage for that long. On the other hand, if you think you might want to change your job and location in 5 years, you might want to consider a shorter fixed period.

Very often variable mortgages are more flexible, and they don’t have ERC.

How much can I borrow?

The general answer is – it depends on your salary and affordability, that’s if you can afford to pay monthly mortgage payments. So, the lenders will consider not only your income but also your personal circumstances such as other commitments, like rising kids or other debts, that can reduce the amount you can borrow.

Historically banks multiplied your yearly income to determine how much they can lend you. A single person can expect 4-4.5 times of their annual salary, or for a couple, their combined income is taken for this. In some cases, bonuses are taken into account, but usually not in full as they are not guaranteed.

If you have a salary of £35,000 per year, your first estimation for a mortgage could be

£35,000 x 4.5 = £157,500

If you have regular bonuses, they could be added but not all banks do it.

Also, some banks want to act prudently, especially for first-time buyers, and multiply only by 4, so in this example, the potential loan could be only £140,000

After that banks will look at your monthly income, your regular bills and payments, and work out the affordability of this mortgage.

If you take a repayment mortgage of £157,500 for 25 years, with 6% interest, the monthly payments will be £1,015 (you can just use a mortgage calculator, for example, https://www.moneysavingexpert.com/mortgages/mortgage-rate-calculator/ or there are many other on the web).

For an annual salary of £35,000, monthly net pay (after taxes) will be about £2,250. If you have a student loan, it’s usually deducted automatically from your salary and this net amount will be smaller.

So now the bank will look at your numbers:

Monthly salary £2,250

Monthly mortgage payments will be £1,015.

Plus you will need to pay for food, council tax, utility bills, food, clothes, transport, mobile, insurance and other usual payments. Will be your salary enough to pay all this every month? Will your other expenditure jeopardise monthly mortgage payments?

If you have big credit card balances or other loans, for example, you pay monthly for your car, all this can reduce the amount that the bank can offer you.

Unfortunately, families with kids also could be punished. They can receive a lower loan because kids do require a lot of additional money, this is the commitment that lenders will take into account. If you plan to extend your family – buy your house first!

Mortgage terms

| Mortgage term The length of time over which the mortgage is required to be paid. |

It used to be that most mortgages were given for 25 years, but now there are many mortgages for 30, or even 40, years. The mortgage term depends on the age of the borrower, for example, a 50-year-old person can’t take a 40-year repayment mortgage. Most lenders expect the mortgage to be paid before the retirement age, but some could allow it to be repaid until the 70s.

The longer the mortgage terms, the smaller the monthly payments, but the interest paid over the life of the mortgage will be higher with longer terms, see Table 6

| Table 6. Loan £100,000, monthly payments for different mortgage terms | |||||

| Mortgage rates | 20 years | 25 years | 30 years | 35 years | 40 years |

| 2% | £506 | £424 | £370 | £331 | £303 |

| Total interest | £21,429 | £27,179 | £33,030 | £39,164 | £45,394 |

| 3% | £555 | £474 | £422 | £385 | £358 |

| Total interest | £33,085 | £42,239 | £51,747 | £61,602 | £71,792 |

| 4% | £606 | £528 | £477 | £443 | £418 |

| Total interest | £45,385 | £58,284 | £71,788 | £85,867 | £100,491 |

| 5% | £660 | £585 | £537 | £505 | £482 |

| Total interest | £58,437 | £75,441 | £93,338 | £112,066 | £131,568 |

| 6% | £717 | £644 | £600 | £570 | £550 |

| Total interest | £71,973 | £93,329 | £115,884 | £139,540 | £164,173 |

| 7% | £775 | £707 | £665 | £639 | £622 |

| Total interest | £86,086 | £112,051 | £139,536 | £168,349 | £198,317 |

| 8% | £836 | £772 | £734 | £710 | £695 |

| Total interest | £100,747 | £131,545 | £164,154 | £198,319 | £233,738 |

| Rent £600/pcm paid over years | £144,000 | £180,000 | £216,000 | £252,000 | £288,000 |

Monthly mortgage payments are lower for 30 years than for 25 years, as the capital payment is spread over a longer period, but you will pay more interest, even with the same rate, as it will be longer.

Certainly, it’s worrying that so much interest will be paid to the lender over the life of the mortgage, but if you compare it with the rent you would need to pay over the same time, interest paid to the bank is smaller even for 8% mortgage. If you take into account that rent will definitely go up in 20+ years, and house prices most likely will also go up considerably too, adding to your wealth, the advantage of having your own house will be even bigger.

TIP: When you consider the mortgage term, you might want to go for safer, longer options to avoid the risk of losing your home. You must pay your monthly amount, and if that puts pressure on you, you will find that every month could be stressful. If you take 30 years to repay instead of 25, your standard monthly payment will be lower. When you have some extra money, you can then overpay your mortgage. Up to 10% overpayment per year is allowed, so you get the same result, but with much less stress. See Table 7.

Overpaying the mortgage

Paying the mortgage quicker can considerably reduce the total amount of interest that you pay over the years. Overpaying a 3% mortgage for 25 years with just an extra £100 per month will save you over £15,000 in interest payments over the whole term. What’s more, it will bring forward the date when you are mortgage-free considerably, as you can see in Table 7.

| Table 7 Overpaying mortgage by £100 per month | ||||||||

| Years | Payments/ Additional Equity | Interest saving | ||||||

| 2% | 3% | 4% | 5% | 6% | 7% | 8% | ||

| 10 | £12,000 | £1,388 | £2,145 | £2,983 | £3,848 | £4,766 | £5,740 | £6,775 |

| 15 | £18,000 | £3,151 | £4,961 | £6,989 | £9,189 | £11,607 | £14,266 | £17,189 |

| 25 | £30,000 | £9,185 | £15,027 | £21,974 | £30,136 | £39,788 | £51,212 | £64,745 |

According to a Which survey in July 2023, 36% of mortgage holders overpaid their mortgage in the last 12 months, with 25% overpaying on monthly basis and over 10% do it from time to time.

Which calculated what happens with the mortgage with regular overpayments, the figures are based on a £200,000 mortgage with a 25-year term and interest rate of 6.36%.

| Table 8. Other monthly overpayments | ||

| Monthly overpayment | Total amount saved over mortgage term | Time taken off mortgage term |

| £0 | £0 | None |

| £5 | £2,147 | 3 months |

| £25 | £10,239 | 1 year, 1 month |

| £50 | £19,371 | 2 years, 1 month |

| £100 | £35,006 | 3 years, 9 months |

| £250 | £68,224 | 7 years, 6 months |

Do you need more flexibility with overpayments?

If you think that you will have spare funds, it’s worth overpaying the mortgage and you better discuss it with the broker. There are other products, which could be suitable, for example, offset mortgages.

Offset mortgage In addition to giving a mortgage, the bank also opens a savings account where you can put your money and take when you want. It is treated as a usual easy-access savings account, but the mortgage interest is calculated based on the difference between the mortgage balance and the amount in this account.

Offset mortgages could be fixed or variable and they provide great flexibility. When you overpay the mortgage, you can’t take the money back until you re-mortgage. Offset mortgages allow you to take the money at any time. Unfortunately, interest rates are often higher but not that much.